Prior To You Apply For A Loan, You Should Carefully Think About The Reason You Intend To Take Out The Cash

Article written by-Marshall Hensley

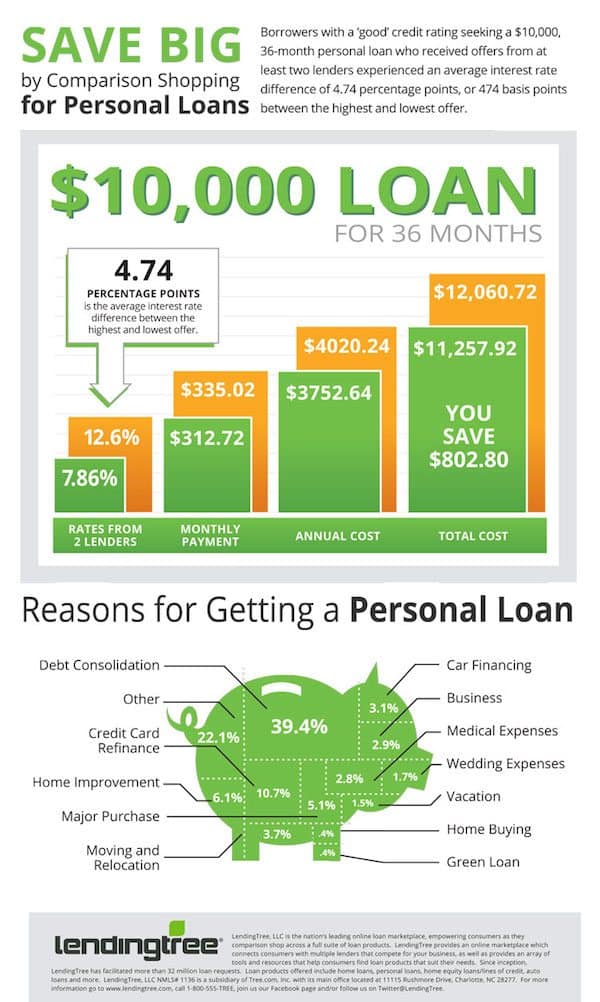

You may require the cash for a brand-new cars and truck, for example, or you may wish to take an unique family members holiday. Then, you should compare the numerous deals and select the one that will certainly be easiest for you to pay back. Choosing the ideal loan provider can be a challenging job, however it can help you obtain the cash you require.

Getting a car loan is easy and also quick. Before using, make sure to have the essential files prepared. These documents can aid the lending institution verify your identity and recognize your monetary circumstance. If you have an excellent credit history, you have a far better chance of being authorized for a financing. If your credit rating is poor, it may be a far better alternative to prevent a financing completely. Regardless of whether you are accepted for a car loan, it is essential to prepare yourself.

Getting a funding is reasonably basic - all you require to do is submit an application online. Relying on the length of time it takes, you can obtain a decision in minutes or a few days. All the same, the authorization of your Car loan is based on your credit report as well as other economic information. Make certain to review the conditions carefully prior to submitting your application. If you're accepted, you can get the money promptly. If not, you can likewise make an application for a finance via your bank.

A funding is an excellent method to spread the cost of a new vehicle or home over numerous months. It can likewise help you settle debts. The procedure of applying for a financing is usually quick and simple, but understanding what to anticipate can assist you increase your possibilities of approval. Nonetheless, prior to you use, consider your individual circumstances and future plans. Your credit report and also other variables might have an influence on your economic scenario and what you wish to buy.

A lending is a great choice if you require the funds soon. Prior to requesting a financing, you must inspect your credit history to ensure that it is in good condition. Paying off financial obligation can assist your credit rating and also reduced your debt-to-income proportion. Prior to making an application for a loan, it is essential to examine your credit report. Identify any kind of mistakes and also make sure it is exact. It is necessary to settle your debts so you can enhance your credit rating.

Before applying for a lending, make sure you have all the appropriate documentation readily available. This aids the business verify your identity as well as your financial circumstance. It will also assist you determine whether to request a car loan or not. After submitting an application for a lending, make certain to ensure to read the terms and conditions. If the Loan is accepted, you'll require to make the payment. Usually, the Car loan application process is easy, yet it is vital that you have all the called for documentation and also credit rating.

As soon as you've picked a lender, you should evaluate the conditions and compare deals. If you're thinking about a protected Loan, you ought to compare the terms and APRC of both financings. Once you've discovered the most effective Car loan, you can get it. You can likewise go to a lending institution's branch personally to obtain a financing. Commonly, this will certainly take much longer, however it deserves it if you can get the information you need.

The Car loan application will certainly request your get in touch with details, earnings, and also other details. Then, you'll have to give your credit history. A lending institution's debt record will allow them to establish your economic circumstance, including your credit rating. If you have negative or no credit score, your credit rating will be a determining factor in whether you'll get a lending. how long does loan approval take , the more probable you are to be approved.

The Car loan application procedure will vary somewhat in between lending institutions. While some lenders can be requested online, others might need you to meet an online person so as to get a decision. http://walton03lonnie.alltdesign.com/when-looking-for-a-business-loan-you-ought-to-compare-rates-of-interest-as-well-as-payment-terms-28270959 , it's important to meticulously evaluate the regards to each offer. There's http://winifred85napoleon.tblogz.com/prior-to-you-apply-for-a-loan-you-must-know-what-you-require-to-prepare-22650446 or incorrect response when it involves making an application for a funding. You should make the best choice for your economic circumstance. When you're requesting a lending, make sure you're prepared. If you've never applied for a financing prior to, it could be a good idea to look for a service that can aid you get a finance.